Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

In this blog post, I’m going to be talking about and breaking down the One Big Beautiful Bill Act. This is the brand new tax legislation that was just passed through Congress last week and then signed into law on July 4th, 2025 by Donald Trump.

There’s been a lot of heated debate surrounding this bill.

Critics are bashing it, calling it horrible and claiming it won’t do a thing to reduce the budget deficit—that it only benefits the ultra-wealthy with no relief for the lower or middle class.

In this post, I’ll break it all down and explore who it truly helps.

Spoiler alert: Yes, it does favor those at the very top of the income spectrum, but it also provides significant tax savings for people in the lower and middle tax brackets. In fact, I believe it helps pretty much everyone, across the board by extending and making permanent, The Tax Cuts and Jobs Act rates—signed into law during Donald Trump’s first term—which created a lower tax structure for nearly all taxpayers.

When we use the word permanent, as it refers to a tax law, it just means there’s no expiration or sunset provision. Permanent is only permanent until new tax legislation is passed by congress and signed into law by the president of the United States.

The last tax bill that was passed back in 2017, called The Tax Cuts and Jobs Act, went into effect in 2018 was scheduled to “sunset” or expire at the end of 2025. So if no new tax legislation was passed, then all of those old tax rates and rules would have expired and we would have reverted back to what we had previously back in 2017.

And…that would have been higher taxes for everyone!

As we go through the post today, I’m going to be looking at not only how this changes future taxes, but also how it could impact your taxes this year in 2025.

Even though the Tax Cuts and Jobs Act is not expiring until December 31st, there are going to be some elements of the One Big Beautiful Bill that go into effect immediately for this tax year. Don’t worry, as far as your taxes go, its all good!

I’ll also be talking about what that would have happened if the Tax Cuts and Jobs Act Rates just expired at the end of the year like they were scheduled to, and the potential increases to our taxes.

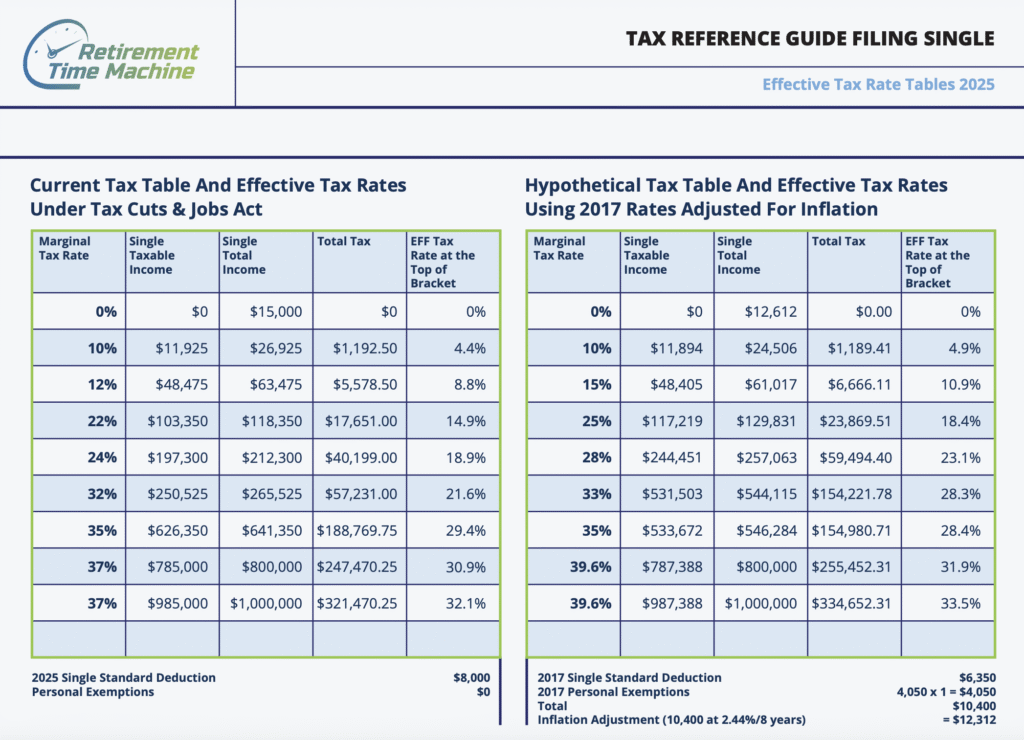

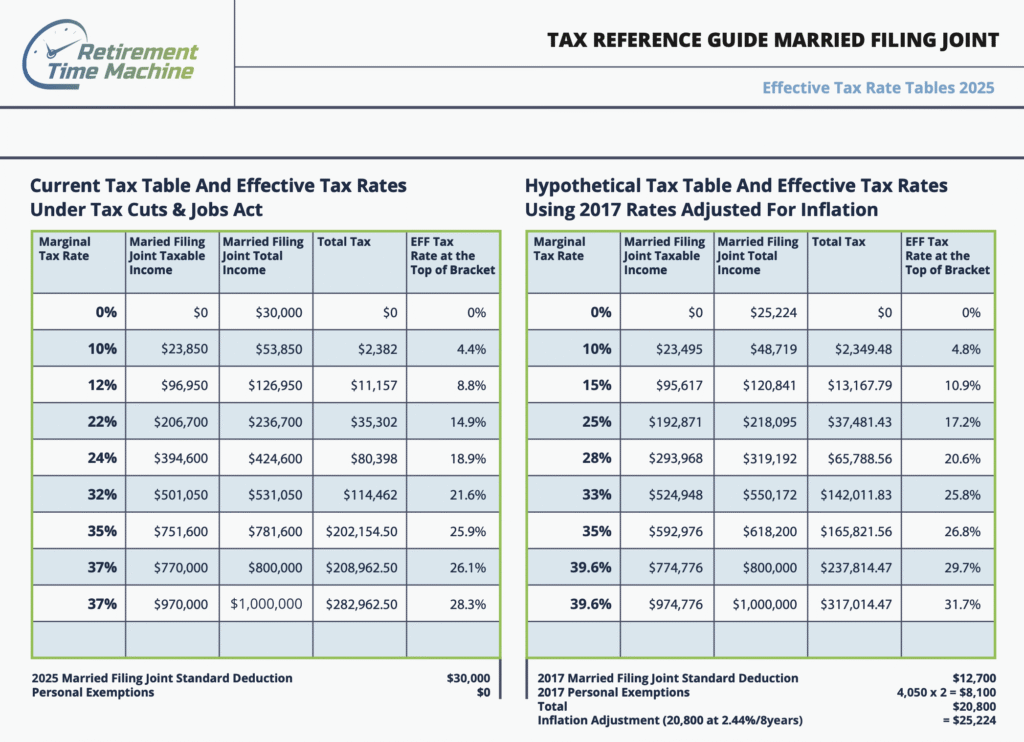

Tax Table Comparison: The Tax Tables What the Tax Rates look like now versus what they would likely look like if the Tax Cuts and Jobs Act Rates were left to expire.

Standard deduction boosts: New enhancements to the standard deduction. Everybody’s going to get a little bit higher standard deduction.

If you’re over the age of 65, there’s a brand new bonus deduction that starts in 2025 and will be in place through 2028.

Itemized deductions updates: A few changes here that everybody needs to know about. Again, I think it’s all probably on the positive side there.

Child tax credit improvements: The child tax credit has been made permanent and increased for 2025 and beyond.

Trump’s campaign promises: Donald Trump’s campaign promises. He really campaigned and had three things, as it was related to taxes.

While we didn’t get exactly that, I’m going to be breaking it down and showing, how close really those campaign promises were either fulfilled or maybe not fulfilled all the way.

Estate tax for high-net-worth individuals: And then we’ll be talking a little bit about the estate tax exemption, which is really just going to apply for people up at the very high end of the net worth spectrum.

The first thing we’re going to look at is the actual tax rates themselves, the tax brackets that we pay on what we call regular ordinary income. This is the rate you pay on things like earned income from your job or business, withdrawals from tax deferred retirement accounts and interest and short term capital gains, just to name a few.

Your marginal tax rate is the highest rate you pay taxes in whatever bracket you get up to. Any additional dollars of ordinary income are taxed at this rate.

The Tax Cuts and Jobs Act rates that were signed into law in 2017 during Donald Trump’s first term in office and took effect in 2018 had a sunset provision and they were set to expire at the end of this year, (2025). And if there were no new tax legislation signed, then effectively the Tax Cuts and Jobs Act rates would expire and we would revert back to the old tax rates that we had back in 2017, probably with some adjustment for inflation.

I made this chart maybe about four or five years ago as a way to help our clients do some tax planning to really understand what is our tax rate today, what does it look like during the next few years while the tax cuts and jobs act rates were still in effect and what does it look like when those rates expire. This helped us to understand where some people were potentially getting pushed up into higher tax brackets from things like retirement plan withdrawals and required minimum distributions. So, we were using this to work on things like Roth conversions and strategies that could take advantage of these low tax rates before they went up.

The Taxes Rates created under the Tax Cuts and Jobs Act have now been made permanent, at least permanent until the next Congress acts.

So if the One Big Beautiful Bill Act (OBBBA), or some other new tax legislation, we would have seen all income brackets higher beginning in 2026. From the very low end of the income brackets to the very highest.

Because tax payers with higher incomes pay taxes at higher rates and at higher amounts of income, by lowering all tax rates, they definitely see the largest reductions in total amount of taxes paid. But, all taxpayers will see a reduction to their taxes. In fact, tax payers with lower incomes actually see the larger percentage drop in their taxes, even compared to those at the upper end.

The Sweet Spot

If you look at the brackets under the OBBBA and the TCJA, the 24% tax bracket is what I’ve been referring to for years as the sweet spot.

The 24% bracket for Married Filing Joint extends up to $394,600 of taxable ordinary income, and when you compare it to the table of the pre TCJA rates with a 2.44% inflation factor, it not only saves money by lower the rate from 28% to 24%, but it also goes into the 33% tax bracket by about $100,000.

So for a couple earning about $400,000 would save about $13,000 compared to what it could gave been had the current Tax rates been left to expire. This is approximate, because we don’t actually know for sure what those old tax rates would have been. My tables are based on the old 2017 rates with an annual 2.44% increase to approximate the inflation adjustments. 2.44% is the inflation factor we use as the default in our financial planning software.

How we got to $13,000 in Tax Savings:

$100,000 at 24% vs. 28%= $4,000

$100,000 at 24% vs. 33% = $9,000

Total Tax Savings $13,000

This is why I refer to this as the sweet spot for being able to take advantage of doing Roth conversions and in some cases changing up contribution strategies to Roth vs. Traditional Retirement Savings Accounts.

If you go further out into the higher end of the tax brackets those tax savings continue all the way up to the highest tax bracket, 37%.

Remember, even if you are making $1 million per year and in that highest tax bracket, your not just saving money at 37% vs. the old tax rates before the Tax Cuts and Jobs Act, but you’re also saving money along the way. As you pass through each bracket some of your income is taxed at 10%, 12%, 22%, 24% 32%, 35% and 37%.

In a nutshell…Everyone!

The last two legislative tax packages, The 2017 Tax Cuts and Jobs Act as well as the One Big Beautiful Bill Lowered all tax brackets. So everyone benefited.

Although some minor restrictions were implemented to limit deductions to income (more on this later), with limits to mortgage interest and the State and Local Tax deductions (SALT), there really hasn’t been an appetite to really go after those upper income taxpayers.

Joe Biden, wanted to keep the TCJA tax rates in place if you made under $400,000, and raise taxes on the upper brackets, but even though Democrats controlled both houses and the White House, it couldn’t even get out of committee. I would have actually be in favor of this, because I am personally very concerned about the level of debt in the US and something needs to be done. Our government also has a really big spending problem too, but we’ll save that for another blog.

So anytime, we see an across the board cut to the tax rates like we have seen in these last two tax bills, the people that pay the most in taxes, have the most to save. My tables above show the amount of total Federal Tax at each of the tax rates and you can compare that to the amount of tax with what it could have been if the Tax Cuts and Jobs Act Rates were left to expire.

So, the amount of pure tax savings that somebody’s going to have if they make a million dollar is going to be a lot greater than somebody that’s making $100,000 or $200,000. But proportionately, if you look at the percentage discount or savings on the taxes at the lower end, it’s often times much greater than what it might be at the higher end, especially when we start looking at some of the other additions to deductions that we’re get into here. These deductions have tended to favor taxpayers in lower or middle income tax brackets.

Using my tables above, I did some quick calculations to look at the potential tax savings, based just off of the tax table itself compared to what it would have been had the current tax rates been left to expire.

For a Married Filing Joint Tax Return

$50,000 taxable ordinary income: About an $839 savings.

$100,000 taxable ordinary income: Saving about $2,500.

$400,000 taxable ordinary income: $18,578 savings.

$1,000,000 taxable ordinary income: $33,461 savings

(but note the total tax paid is much higher: $317,000 on old rates vs. $282,962 under the new bill).

Let’s get into how your taxes are actually calculated…

As we talk about tax planning and tax strategy its important to understand that there’s really two factors that determine how much tax we’re going to pay.

Factor 1: Your tax rate: That’s our actual tax rate and the percentage that you pay on your income and the different levels along the way.

Factor 2: Taxable income amount: How much of your income is going to be subject to that tax because there are going to be some opportunities to take deductions from your total income to arrive at your taxable income or your income tax base income.

Standard Deduction vs. Itemizing: What’s Your Best Option?

When you file your income tax return, you have a choice:

If your total itemized deductions add up to more than the standard deduction, then it likely makes sense to itemize. Otherwise, most taxpayers will benefit from taking the standard deduction.

The Tax Cuts and Jobs Act nearly doubled the standard deduction as well as created new limitations to itemized deductions such as mortgage interest and State and Local Taxes (SALT). As a result the number of tax files itemizing deductions has fallen from about 31% in 2017 to just 9% of tax returns in 2021. (The last year with data as of this article)

The One Big Beautiful Bill Act kept some of those limitations in place, adding a small limitation to charitable donations, while expanding the SALT Cap, Interest on auto loans and mortgage Insurance.

The One Big Beautiful Bill Act kept in place those same higher standard deduction amounts but added to them slightly taking effect for 2025.

New Standard Deductions for 2025 Pre and Post OBBBA

(Create Table here)

Single,”$15,000″,”~$15,750″

Married Filing Joint,”$30,000″,”~$31,500″

Head of Household,”$22,500”,”~$23,625″

The original Senior Bonus deduction was first introduced in 1948 and has been made a “permanent” part of the tax code. Originally set up as an addition to personal exemptions at $600, it has increased over the years. (Not a part of the OBBBA)

If you qualify, you get this extra “bonus deduction” whether you take the standard deduction or choose to itemize.

The 2025 the Age 65+ bonus deductions

The New Age 65+ Bonus Deduction

One of Donald Trump’s campaign promises was no tax on Social Security. (I was a really big fan of this).

Social Security was never taxed until 1984, when up to 50% of your Social Security Benefits could be subject to tax. In 1994 this was increased to 85%.

The earnings income thresholds to determine the tax on Social Security, were set in place in 1984 and 1994 and have never been adjusted for inflation, so more and more taxpayers are getting hit with this tax, especially since 50% of your Social Security benefits are used in the “combined income” calculation. For some taxpayers, your Social Security Benefits alone might be enough to trigger the tax.

Unfortunately there was too much pushback on this, with some members of congress concerned that the loss of revenue from these taxes would lead to bigger deficits that would be difficult to make up.

As a consolation, congress agreed to a limited extra bonus deduction for taxpayers over age 65+ for the years 2025 through 2028.

While this may seem like a far cry from what Trump campaigned on, no tax on Social Security, its still better than nothing.

Here’s how the new age 65+ Bonus Deduction Works

Instead of the no tax on Social Security, what we got instead was an extra bonus deduction, in addition to the original $2,000/$1,600 per person deduction for those 65 or older.

Under The One Big Beautiful Bill Act, you would get an extra $6000 deduction, per taxpayer 65 or older. Unfortunately, this deduction is only in place for tax years 2025 through 2028. (unless extended by new tax legislation)

Just like the original senior bonus deduction, you will get this extra deduction whether you take the standard deduction or if you choose to itemize.

Personal exemptions were eliminated in 2018 with the Tax Cuts and Jobs Act, but were scheduled to return in 2026 after the sunset.

These personal exemptions were a deduction you received for every dependent in your household, including you and your spouse. In 2017, personal exemptions we just over $4,000.

The substantial increase to the standard deduction in 2018, was the trade off for eliminating the personal exemptions. Depending on how many exemptions you were able to claim, most people probably benefited from the higher standard deduction. However, families with 3 or more dependents probably lost out on this.

Expansion and substantial increases to the Child Tax Credit, most likely netted a substantial benefit for most families. (see below)

Under the One Big Beautiful Bill, personal exemptions have been “permanently” eliminated.

With the elimination of personal exemptions in 2018, came big changes to the Child Tax Credit under the Tax Cuts and Jobs Act.

How the Child Tax Credit worked before the One Big Beautiful Bill and the Tax Cuts and Jobs Act.

Before the Tax Cuts and Jobs Act went into effect, the Child Tax Credit was $1,000 per qualifying child.

There was also an Income threshold with a phase out based on your Modified Adjusted Gross Income (MAGI)

For low income taxpayers refunding the tax credit was more difficult under the old rules, and was based on earned income requirements.

Tax Cuts and Jobs Act doubled the Child Tax Credit to $2,000 per qualifying child and substantially increased the income thresholds, making it available to more middle and upper middle class taxpayers.

There was also an Income threshold with a phase out based on your Modified Adjusted Gross Income (MAGI)

Married Filing Joint $110,000

Single/Head of Household $75,000

The Child Tax Credit under The One Big Beautiful Bill

To qualify for The Child Tax Credit you must meet the following criteria:

When you file your taxes, you can choose to take the standard deduction or itemize your deductions—whichever gives you the greater tax benefit.

Under the One Big Beautiful Bill Act, most of the structure around itemized deductions remains similar to what was in place under the Tax Cuts and Jobs Act (TCJA). However, several key enhancements make itemizing more beneficial for some taxpayers, especially those with higher mortgage interest, charitable contributions, or state and local tax payments.

If your itemized deductions exceed the standard deduction for your filing status, it can reduce your taxable income and potentially lower your overall tax bill. With the standard deduction amounts increasing under the new law, fewer people will need to itemize—but for some, it still makes sense.

Mortgage Interest and Home Equity Changes

Mortgage interest may be one of the more common itemized deductions.

If you’re paying interest on a home loan, you may be able to deduct a portion of that interest, but only up to certain limits.

Under the Tax Cuts and Jobs Act, the cap on deductible mortgage debt was reduced from $1 million to $750,000 for loans taken out after December 15, 2017. That change hit higher-income households the hardest—especially those with large mortgages or expensive homes. If you’re in a higher tax bracket and have a mortgage over $750,000, you’re no longer able to deduct all of your interest.

That cap remained in place under the One Big Beautiful Bill Act, so for those with larger mortgages, some of that interest will remain non-deductible.

Home Equity Loan Rules:

Another change that carried forward from the TCJA involves home equity lines of credit (HELOCs). In the past, you could use a HELOC for just about anything—consolidating debt, buying a car, or covering personal expenses—and still deduct the interest.

Both under the TCJA and the One Big Beautiful Bill Act, interest on home equity loans is only deductible if the funds are used to “buy, build, or substantially improve” the home** that secures the loan. So if you’re remodeling your kitchen, finishing a basement, or replacing your roof, the interest may be deductible. But using a HELOC to pay off credit cards or fund a vacation won’t qualify.

Mortgage Insurance Deduction Returns

One new benefit under the One Big Beautiful Bill Act they’ve brought back the deduction for mortgage insurance premiums (PMI). This deduction had previously expired but is now available again.

This could be a nice break for homebuyers—especially younger adults or first-time buyers—who might not be able to put 20% down and are required to carry PMI. If you’re paying for mortgage insurance, that cost can now be included as part of your itemized deductions.

Charitable Contributions: New Rules Under the One Big Beautiful Bill

Charitable giving continues to be a key component of the itemized deduction list—but there are a few important updates under the One Big Beautiful Bill Act that taxpayers should understand.

First, if you itemize your deductions, there’s now a 0.5% adjusted gross income (AGI) floor for charitable contributions. This means the first 0.5% of your AGI in charitable donations is not deductible. For example, if your AGI is $100,000, the first $500 of charitable giving wouldn’t count toward your itemized deductions—only amounts above that would be deductible.

A New Above-the-Line Charitable Deduction

In addition to this, the OBBBA, introduced a brand new above the line charitable deduction, available to all taxpayers whether you itemize or not.

* Single Filers, can deduct up to $1,000 in charitable donations.

* Married filing joint, can deduct up to $2,000.

This deduction is taken in addition to the standard deduction and does not affect your eligibility for other deductions, like the Senior Bonus.

So even if you don’t itemize, you can still get a tax break for charitable giving.

State and Local Tax (SALT) Deduction Expanded—But Only Temporarily

One of the most hotly debated provisions in the One Big Beautiful Bill Act was an increase to the SALT deduction short for State and Local Taxes. This includes:

Previously, Under the Tax Cuts and Jobs Act (TCJA), the SALT deduction was capped at just $10,000, which significantly affected higher income households in states with high property values or state income taxes.

Under The One Big Beautiful Bill Act that cap was raised dramatically to $40,000.

Important: This Increase Is Temporary

This expanded SALT deduction is only available for tax years 2025 through 2028. After that, unless further legislation is passed, the deduction limit is scheduled to revert back to $10,000 in 2029.

If you’re in a higher tax bracket and can fully take advantage of the expanded SALT deduction, the benefit can be significant. For example, if you’re in the 24% marginal tax bracket and claim the full $40,000 SALT deduction, that’s potentially $7,200 in additional tax savings vs. the previous $10,000 limit.

New Car Loan Interest Deduction (2025–2028)

The One Big Beautiful Bill Act introduced a brand-new tax deduction for interest paid on car loans, but there are some important qualifications and limitations.

Auto loan Interest Deduction, What Qualifies?

This provision was designed to support the U.S. auto industry while giving taxpayers a break on high-interest car loans.

Auto loan Interest phase out and limit

To be able to take this deduction your income needs to under a certain level based on your Modified Adjusted Gross Income (MAGI)

Above those thresholds, the deduction phases out gradually and disappears completely for higher-income earners.

Is It Worth It?

While the $10,000 limit sounds generous, most taxpayers won’t come close to maxing it out. Here’s why:

A $30,000 loan at 7% interest would generate about $2,100 in interest in the first year.

It would take a much larger loan—or a very high interest rate—to hit that $10,000 cap.

But those with large car loans are often in higher tax brackets—and likely earn too much to qualify.

Still, for middle-income households financing a new car, this deduction could mean a few hundred dollars in tax savings per year—a helpful perk during a time of rising auto loan costs.

No tax on tips was a big part of Donald Trump’s campaign. As the One Big Beautiful Bill moved through congress there was some compromises made on this as well as it was signed. However if you’re in a tipped industry, this is still a really good deal.

Here’s how No Tax on Tips works under The One Big Beautiful Bill Act

First off, this is going to be another above the line deduction and it’s up to $25,000 per person. If you’re single, you get $25,000 of TIP income excluded from your federal income taxes. If you’re married and both you and your spouse are earning tip income, you each get a $25,000 deduction.

To qualify, you must be working in what is considered a “tip industry”. The IRS is expected to release guidance on this in the near future. However, it’s likely going to be your traditional jobs like a server, bartender, barista etc. maybe ride share drivers, or anything like that.

The new deduction allows for you to exclude up to $25,000 in qualified tip income from your taxable income. Because this is an above the line deduction, you do not have to itemize your deductions. You qualify even if you’re taking the standard deduction.

“Cash Tips Only” Misconception

I’ve see some posts on social media saying, “Yeah, it only applies to cash tips, so if you’re customer pays with a credit card you’re not going to qualify for that.” This is false. The method of payment that your customer chooses, does not impact this deduction, whether that’s dollar bills or it’s a credit card, you’re still going to qualify.

No Tax on Tips Income Limits and Phase Out

There is a phase out for this deduction based on your Modified Adjusted Gross Income (MAGI), but its pretty generous. For a single filer, it’s $150,000 of income and married filing joint, it’s $300,000. If you’re over those limits, the deduction would start to get phased out, so, you may not get to utilize the full $25,000.

What if both spouses work in a Tip Industry?

If my spouse and I both work in a tip industry and I have $30,000 worth of TIP income, but my spouse only has $20,000 of TIP income. Can I use the extra $5,000 that I have and have my spouse use that towards their cap? Unfortunately, you cannot share the tip cap. You would be limited to your 25,000 and 5,000 would be taxable. Your spouse would get their $20,000 deduction for their tips.

Important Notes on Taxes and Sunset

Even though this is going to be a reduction to your federal income taxes, your payroll taxes like your FICA, Social Security, Medicare taxes, and State taxes, those are still going to apply. This is just for your federal income.

The No Tax on Tips does have a sunset provision. This deduction will only apply for tax years 2025 through 2028.

This is a big deal if you’re in that tip industry.

If you’re in the 24% tax bracket this could be a tax savings of up to $6,000 for one qualifying person. If both you and your spouse qualify and hit that $25,000 limit, it could save $12,000 in taxes.

Another issue that Donald Trump campaigned on pretty extensively was the no tax on overtime. Again just like the no tax on tips, there are going to be some restrictions and limits to this deduction.

Here’s how the No Tax on Overtime works, One Big Beautiful Bill Act

This is an above-the-line deduction—meaning you can claim it whether or not you itemize your deductions. Here’s how it breaks down:

What’s Considered “Overtime Premium Pay”?

This deduction applies only to the extra compensation received for overtime work—not your base pay. For example:

If your standard pay is $40/hour, and you receive time-and-a-half for overtime, you’d earn $60/hour for those extra hours.

The $20/hour premium (the amount over your base rate) is what qualifies for the deduction—not the full $60/hour.

It can also include holiday pay or weekend differentials, depending on how your employer classifies them.

Who Qualifies and When?

This deduction is available for a limited time only—from 2025 through 2028.

Income phase-outs apply:

Single filers: Phase-out begins at $150,000 of Modified Adjusted Gross Income (MAGI)

Married Filing Jointly: Phase-out begins at $300,000 MAGI

If your income is above these thresholds, the benefit gradually phases out.

Other Important Notes

One of the more significant updates in the One Big Beautiful Bill Act is the increase to the federal estate tax exemption—a key benefit for wealthy families focused on legacy planning.

Let’s take a quick look back:

Before the Tax Cuts and Jobs Act (pre-2018):

The estate tax exemption was roughly $5.5 million per person, or about $11 million for a married couple.

Under the Tax Cuts and Jobs Act (2018–2025):

That exemption amount was dramatically increased and continued to rise with inflation.

By 2025, it reached $13.99 million per person—nearly $28 million for married couples.

What’s New Under the One Big Beautiful Bill Act?

The new legislation, signed into law on July 4, 2025, bumped the federal estate tax exemption up again:

$15 million per person

$30 million for married couples

That’s an additional $1 million per person in tax-free estate transfers—and importantly, this exemption is now permanent (at least until Congress decides to change it again in the future).

For high-net-worth individuals and families, this is a major opportunity to pass along wealth to heirs free of federal estate taxes—making legacy planning more powerful than ever.

In future blog posts, I’m going to take a deeper dive into how the One Big Beautiful Bill Act impacts:

I’ll also be comparing how much you might owe under this new tax law versus:

This will give you a clearer picture of where you stand—and more importantly—how to plan ahead.

Stay tuned, and if you haven’t already, consider subscribing or downloading one of our free planning guides to make sure you’re prepared for what’s next.

Disclosure: Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.