Are you getting serious about Planning for your Retirement?

Now... Build a Retirement plan that actually matches up with the things that are most important to you, in just a few hours without spending a ton of money or getting all stressed out trying to figure it out on your own.

Keep reading on, to learn how you too can take the stress and uncertainty out of creating a plan for your retirement

The Reality of Not Having a Plan For Your Retirement

Today more than ever, with high inflation, increased stock market volatility and high healthcare expenses, every decision you make is one that can affect you for the rest of your life.

All of this can lead to feeling overwhelmed, worried and stressed with what seems like an endless list of things to do before you retire.

If you’re feeling like this, its normal, and you’re not alone.

The truth is, we were never taught any of this, and it doesn’t come naturally to most people.

Many of us simply relied on information we got in bits and pieces from friends, family and co workers. Unfortunately, advice that may have been good for one person, may not be good for you.

Using a financial advisor could help, but the truth is, most financial advisors focus on investing, and don’t really get into the kind of detailed planning necessary to really give you the confidence you’re looking for in your retirement planning decisions.

So then you’re left with trying to figure this all out on your own…

and without a plan for your retirement the worry, stress and uncertainty won’t go away, and you could end up making a mistake that ends up costing you a lot of money.

I believe the happiest people in Retirement are those that have a clearly defined plan

They understand exactly what they want their retirement to look like based on the things in life they value the most. They feel confident in how their financial resources will provide for their cash flow needs.

So, what if you had a set of step-by-step instructions for building your own custom retirement plan? Imagine if you could follow these steps with paint-by-numbers precision and simplicity… EVEN if you’re a newbie to all of this personal finance and retirement planning.

No more overwhelm!

No more wondering if you’re making the right decisions!

No more wasting time or money!

Imagine for just a moment…

…that you had a step-by-step process for creating a retirement plan that actually gives you that confidence…

…imagine you could create it in as little as a few hours…

And once it’s done… you would have answers to all of those questions that have been racing trough your mind! The worry, the stress would turn to confidence.

Wouldn’t that be nice?

Introducing...

The Retirement Time Machine is much more than just an online course or another do it yourself retirement plan.

…It combines both into a transformational process that takes you from wherever you are in your retirement planning journey to a crystal clear plan for your retirement.

The Simple Step-by-Step, System for planning your Retirement…

or Your Money Back!

Here’s what you will get when you enroll in the Retirement Time Machine…

- Step by Step videos with easy to follow worksheets guide you through every step of the retirement planning process

- 12 Months of the Retirement Time Machine Navigator, where you can build your own high level retirement plan using the eMoney Platform

- 12 months access Monthly Livestream Q&A. If you need help or get stuck, we’re here for you.

- Lifetime access to all of the RTM course material including any future updates to the course and all of the Bonuses!

Module Breakdown

Module #1 Building your Foundation

Do you have the right map? You’ve probably been thinking about retirement your whole life and now that its getting closer you may be trying to make sense of all of the different pieces and the decisions you need to make.

In this module we’ll help you organize your retirement resources in a way that brings it all together to really help you get clear on your retirement and what’s possible.

Inside Module #1 You’ll Discover…

- How to design your perfect retirement so that it matches with the things in life that are really most important to you

- Tools to build your retirement map so that you don’t have any surprises

- How much money you should be saving each year for retirement and why many people are actually saving too much

- What to do if you’re behind on retirement planning and why it’s never too late to still plan for your dream retirement.

Module #2 Your Retirement Accumulation Strategy

As you get closer to retirement you may begin to see your excess cash flow improve significantly.

Paying off your mortgage, kids moving out on their own, and experiencing a surge in income from your career or business.

Taking advantage of these final years before you retire can really make a huge difference in your retirement, especially if you think you’re behind in your retirement saving.

This module will empower you with the knowledge and strategies to make the most of this critical phase.

Inside Module #2 You’ll Discover…

- Little known tips that could really supercharge your retirement savings

- Why saving money in the wrong type of account, could cost you more money in taxes in your retirement

- What to do when your already maxing out your 401k plan

- Common Mistakes you could be making with your retirement asset allocation

Module #3 Your Retirement Withdrawal Strategy

Congratulations you have accumulated enough savings and investments to retire! However, transitioning from receiving a regular paycheck to relying on your retirement funds and resources can be understandably scary.

In this module, we address one of the most crucial aspects of retirement planning: creating a retirement withdrawal strategy.

Inside Module #3 You’ll Discover…

- How to create a retirement withdrawal plan to fill your Cash-Flow Gaps

- How to decide whether to take a pension lump sum or keep the monthly payment.

- When to collect Social Security and how to coordinate it with other sources of retirement income.

- 3 things you need to do with your retirement accounts before you retire.

- Which accounts to take withdrawals from first that can reduce your long term taxes

Module #4 The Navigator

This is where it really starts to come together!

We’ll take what you’ve learned so far and help you build your own custom retirement plan.

We call it the Navigator, and it’s built on the powerful eMoney financial planning platform.

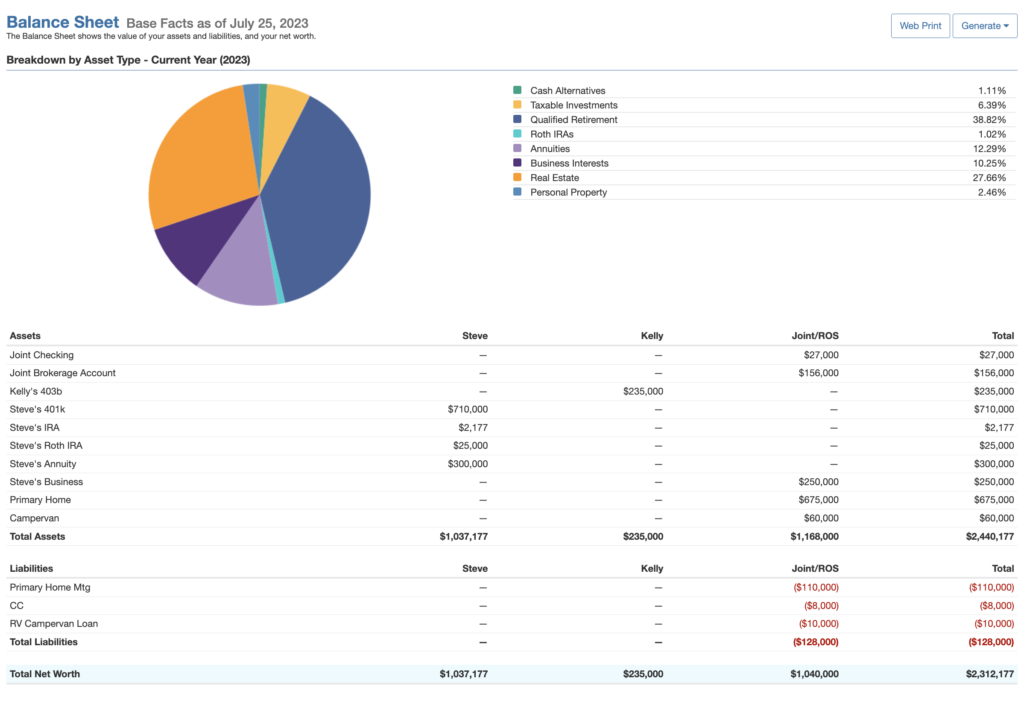

Here is just some of what you can do inside the Navigator…

Link Your Accounts

- With a single Log on, see values and positions across all of your financial accounts in real time

- Create a budget and Track expenses

- Gain powerful insights into your investment holdings and asset allocation

Mapping Your Cash Flow

- Identify your cash flow gaps now and in the future, so you can build your retirement withdrawal strategy with precision

- Plan out future expenses over time

- Forecast your Required Minimum Distributions

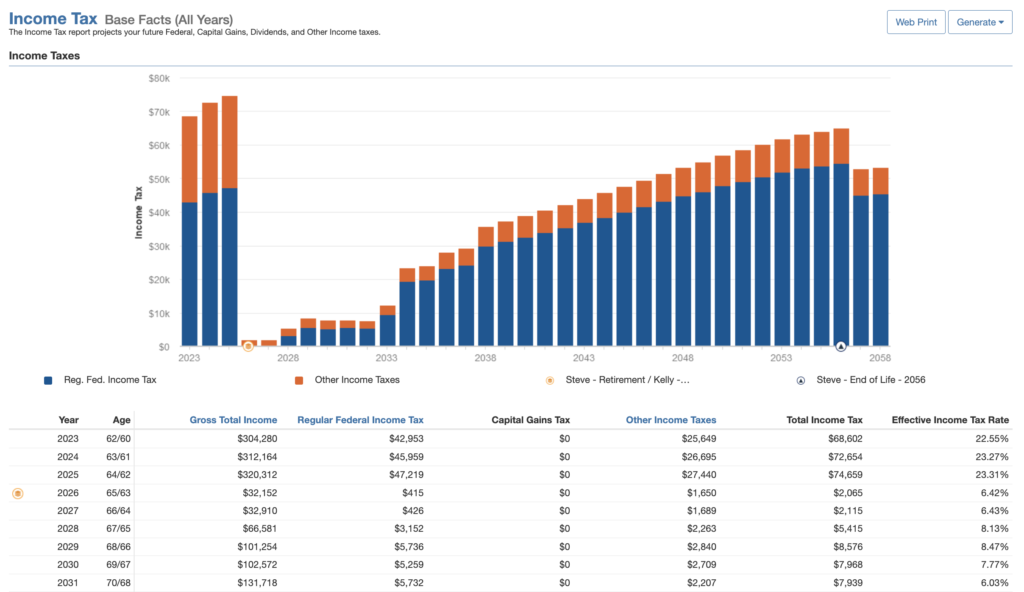

Income Tax Planning

- View key tax information such as your effective tax rates, Taxable Income and even your state taxes

- Identify “low Tax Years” to help coordinate retirement withdrawals and plan Roth Conversions

- Know how much “room” you have left before you go into the next tax bracket

- Answer the question, will you be in a higher or lower tax bracket when you retire

"I've helped thousands of individuals become more confident about their plans for retirement, and now it's your turn"

My high level one-on-one comprehensive WealthVision financial plan costs $3,600. At one point, the demand was so high, I actually had to shut it down and turn people away.

The people I helped over the past few years came to me because they were looking for answers to their most important retirement questions and they struggled to find answers.

Maybe you have experienced this too…

When it comes to creating a plan for your retirement you have 3 options:

- Ask friends and relatives for a referral. Schedule appointments with a few of them, only to find out that most are focused on selling their investment services and really don’t do financial planning.

- Spend an entire weekend building a spreadsheet to map out your retirement… or try using one of the low cost or free online tools. It might work, but often it still lacks details without really answering your questions

- You find a financial planner like us, to work with you one on one to build a custom stand alone financial plan. The cost for a custom plan can vary, however, according to the FPA Planning Fees Study the average cost for a flat fee financial plan was $2,250

It’s for this reason that I want to make sure I get this program to as many people as possible. I designed the Retirement Time Machine to deliver a high level detailed plan through a DIY experience at a fraction of the cost for a custom plan.

The Double Guarantee

I know that The Retirement Time Machine is going to help you with all of your most important retirement planning goals, but just in case, here's my double guarantee to you

When you join the Retirement Time Machine, you’ll also get access to these 5 bonus presentations

Let's Recap

When you join The Retirement Time Machine you get instant access to the 4 core workshop modules plus 12 months of the RTM Navigator (eMoney portal) to really help take your retirement planning to a whole new level

Providing confidence, clarity, and answers to your most important retirement planning questions!

FAQs

Why is it called the Retirement Time Machine?

If you think about it, when you plan for your retirement you’re really planning your future. As I was creating the program, I started to imagine a time machine where you could revisit your past, and think about what things in your life are most important to you, your values. Then leaping into the future to imagine what you want your retirement to look like.

How is this different from the WealthVision Financial Plan?

WealthVision is our premier one-on-one financial plan and currently has a cost of $3,600. The Retirement Time Machine is intended to be a much lower cost option where participants build their own retirement plan. RTM is a fraction of that cost.

How long do I have to access the course?

You will have lifetime access to the course and all of the bonus modules, including any future updates to the Retirement Time Machine. All you have to do is log into your member portal and the Retirement Time Machine will be there.

Do I need to be tech savvy to use the portal?

There is no software to download or fancy computer needed to access your eMoney Portal. You simply log into the secure website from any computer, iPad, Tablet etc. As long as you have access to the internet you’re good to go. With my step by step videos I’ll walk you through the entire process.

What if I have questions, can I talk to a real person?

I will be hosting periodic livestream Q&A Sessions at least once a month, which is an excellent opportunity to ask pretty much any questions you have. You can also email any questions to our office and someone will respond within a business day or two.

You say I have access to the eMoney Portal for 12 month’s, what happens after that?

After your initial 12 months access to the eMoney Portal, you have the option to continue your access for a cost of $19.97 per month. You would also have access to all of the monthly livestream Q&A sessions.

How long will it take me to complete the program?

There are over 13 hours of video instruction in the course if you really want to take dive deep on all of the topics. However, if you have already completed the RTM Quickstart workshop, you can jump right into the Navigator and knock out a pretty solid plan in just a few hours

I’ve used other retirement planning tools, how is this different?

eMoney is the one of the best and most advanced financial planning tools on the market today, built for financial planners. I believe RTM is the only program of its kind that gives you this kind of access to such a powerful tool.

You say that eMoney is a tool for financial planners, does that mean it’s hard to use?

Not at all. With easy to follow videos I’ll walk you through the entire process to get your information into your plan and most importantly teach you how to interpret the reports so you can make more educated decisions for your retirement

Terms and Conditions

The Retirement Time Machine is an online course intended for educational purposes only. Before making any financial or investment decisions you should always consult with appropriate professionals such as a C.P.A. , Financial Advisor, or Attorney.

The Retirement Time Machine also includes the ability to build your own financial plan using eMoney Financial Planning Software. We call this the Retirement Time Machine Navigator. This is a do it yourself financial plan and time and care should be taken to ensure that you have entered the information into your plan correctly and that you know how to interpret the reports. Throughout the course, video instruction along with PDF’s and worksheets are provided to assist in the data entry and report interpretation. Please make sure you watch and pay attention throughout all of the video’s. Periodic live group Q&A sessions will also provide an opportunity to help you understand your plan.

You will have lifetime access to Retirement Time Machine course, including all video’s, PDF’s and worksheets.

The Retirement Time Machine Navigator will be available to access for a minimum of 12 months from your date of purchase.

For an additional cost, periodic offers may be made to engage in one on one financial planning advice. These one on one financial planning engagements will be made under a separate financial planning agreement, and would offer the ability to review and check that your financial data have been entered into the software correctly, interpret reports and receive individualized financial planning recommendations.

Disclosures

Securities and advisory services offered through LPL Financial, a registered investment advisor, Member FINRA/SIPC. Financial planning offered through Money Evolution LLC, a registered investment advisor and a separate entity from LPL Financial

Tracking: 435514-1:

Copyright Money Evolution – 2024 – All Rights Reserved

Financial Planning Services offered through Money Evolution LLC, a Michigan Based Registered Investment Advisor and separate entity from LPL.

Investment management associated with this site may only discuss and/or transact securities business with residents of the following states: Securities: AR, AZ, CA, CO, CT, DE, FL, GA, IL, IN, KY, MA, MD, MI, MS, NC, OH, SC, TX, VA, WA, WI Insurance: FL, MA, MI, TX and WA.

Securities and Advisory services offered through LPL Financial, a registered investment advisor

Check the background of investment professional associated with this site on FINRA Brokercheck